Loss, Cycles, and the Seeds of Renewal

The current war in Ukraine and mounting headwinds to the bull market in stocks of the last 12 years are giving us investors a first-hand reminder that investment losses are an integral component of achieving long term success. After all, the principle of “buy low, sell high” can only be activated if we can stay objective during the intense moments of fear and uncertainty and deploy the methodology of rebalancing though the bear market periods.

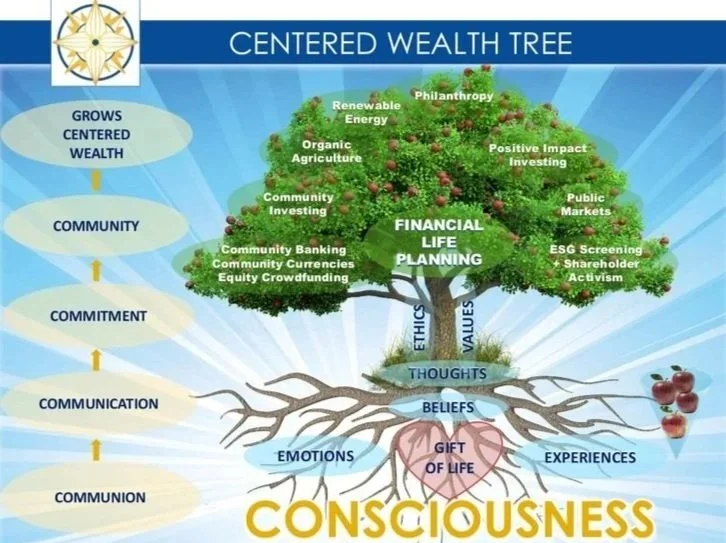

This is also a time to appreciate that all living systems in nature, including human crafted systems, unfold in cycles. Markets unfold through a pulse of expansion and contraction. If history is any guide, over time human creativity and enterprise, combined with the social invention of money and markets, have resulted in net new wealth creation. Will this bear market phase be different? The answer is always an unknown, but what is known is that the path to a grounded experience of Centered Wealth comes through the understanding and acceptance that markets are simply a cyclical reflection of collective human enterprise. We at Centered Wealth believe the economy in turn is embedded in the field of consciousness, a universal system governed by natural cycles which drive the evolution of all life on this planet. In our opinion, humanity would be wise to begin the process of transforming our economic system to better align with natural systems and cycles!

Through the investment lens, Jina and I have a front row seat for glimpsing the scope and depth of the tremendous rate of creative destruction underway as old economic paradigms give way to the seeds of the emergent growing green economy. The principles driving this transformation are increasingly governed by a growing accountability to Environmental, Social & Governance (ESG) commitments. This is part of a long-term process of evolving the debt-based growth model driven by a “profit first” mandate, towards a more integral model of Ethical Biomimicry Finance (EBF). EBF provides a biologically based framework that endeavors to deliver a blended return model that expressly values the aspects of environmental and human capital necessary to maintain a healthy society and planet. While this model is still a work in progress, the Principles of Ethical Biomimicry Finance (http://www.ethicalmarkets.com/wp-content/uploads/2012/10/transforming-finance-report.pdf) and the Ethical Markets Quality of Life Indicators (https://ethicalmarketsqualityoflife.com/overview/) have been in the public domain for years now and are key inputs into the global Transforming Finance initiative underway.

Which brings me back to the theme of loss and renewal. Our dear mentor Hazel Henderson, futurist, economist, environmentalist, and architect of the Ethical Biomimicry Finance, Quality of Life Indicators, and the global Transforming Finance initiative, passed and went “virtual” (her words) on Sunday, May 22nd. Hazel has been a Mother Tree Mentor to the environmental movement for 60 years and whether we know it or not, most of us owe a significant component of our worldview to Hazel’s efforts. For an excellent survey of her life and contributions, here is her obituary from the Washington Post: https://www.washingtonpost.com/obituaries/2022/05/23/futurist-author-hazel-henderson-dead/

I had the good fortune to read her first book, The Politics of The Solar Age: Alternatives to Economics, during my undergraduate work in 1982 and later as her financial advisor beginning in 2003. The guidance and collaborative example that Hazel has given me over this period have profoundly shaped how I view the economic transformation underway. During this period the Centered Wealth Tree model emerged based on my long-term practice of Transcendental Meditation. (https://www.centered-wealth.com/cw-tree-model) Through extensive discussions about consciousness and markets, in which Hazel shared her role in developing the model of Buddhist Economics with economist E.F. Schumacher, she took up the practice of meditation in her later years as part of her preparation for “going virtual”.

Three weeks before her passing Hazel called to impart her final goodbye including the essence of her core message which is to live by The Golden Rule. Additionally, here are some quotes from my notes of that conversation:

“Money & Markets are wonderful inventions but the path to common prosperity cannot be achieved solely through an impartial transactional marketplace. We must re-build and value the ‘love economy’ which is based on trust, empathy, and reciprocity.”

“Markets play an important role, but in many aspects of human endeavor they are ill equipped to meet the essential human needs provided by the love economy.” (https://hazelhenderson.com/the-love-economy/).

“We must go beyond the market and the impersonal pricing system if we ever are going to find our way to fulfilling the core human need for trusting relationships.”

My observation is that the human family is desperately thirsty for connection, meaning, and trust in life. Collectively, we have arrived at an existential crisis where we have lost a connection to the wholeness of life and lack a philosophical context to help us understand the role of self in society. This lack of connectedness to the wholeness of life has occurred as a result of 500 years of scientific reductionism. Out of this reductionist paradigm we have built a “take-make-waste” economic model that has reduced the status of the individual to that of a passive consumer, the wellbeing of which is further reduced to a metric of Gross Domestic Product (GDP). From a political and economic point of view the value of the individual in America has evolved from that of a Human Being engaged as an active citizen to that of a “human doing” valued only as a component of GDP. To Hazel, this was clearly too narrow a model from which to realize the full potential of the human species, much less the American dream.

As the Centered Wealth tree model illustrates, the path to widening the lens of economy and finance begins with an investment of attention inward to re-establish a reliable internal experience of communion with Life. From this foundation, we are then better able to communicate and effectively engage with others who share our common vision. This in turn creates new emergent markets to support the fresh societal trends. This ever-present social dynamic, served by the transactional efficiency of money, is what builds a renewed expression of community which, for the active citizen, is the seat of true resilience and commonwealth.

My hope is that the Centered Wealth family can use our investment experience to build a foundation for a renewed faith in human creativity and potential. Remember Margret Meade’s famous quote: “Never doubt that a small group of thoughtful, committed citizens can change the world, indeed it is the only thing that ever has.” Hazel certainly lived this model to our collective benefit!

One approach I have been collaborating on for over a decade now to fulfill on Margret Meade’s wisdom and Hazel’s example is the development of a methodology that gives individuals easy access into this conscious community building process. The Key Influencer Network Strategy (KINS), developed by a member of Hazel’s sisterhood, Susan Davis Moora, has a new website at www.KINShipearth.org. Feel free to look and see if there are any actionable ideas that would help you in the trust and community building process.

Let’s all raise a toast to Hazel and honor her example by giving life our best!

- Stuart T Valentine

Information obtained from sources believed to be reliable but we cannot guarantee its accuracy or completeness. Past performance is not indicative of future results.