Centered Wealth exists because we believe that in capitalist countries, one of our greatest levers for change is how we spend and invest our money. To send a clear financial message to those in power, Minnesota is calling for a general strike this Friday, January 23rd. If walking out of work or school isn’t feasible, please join us by not spending any money, not making financial transactions, and pausing investment activity for the day.

Read MoreWhenever I am faced with an extreme circumstance whether it has come in the form of a relationship challenge, political event, or market dislocation (think March 2020), I endeavor to…

Read MoreValues-aligned investing, shareholder activism, and their role in creating a healthier world.

Read MoreStuart Valentine sits down with Sustainable Living Coalition Co-Director Bob Ferguson for a dialogue on the SLC's role in working to strategically enhance the local food system - a challenge relevant to any local community with a desire to generate a more robust local food economy.

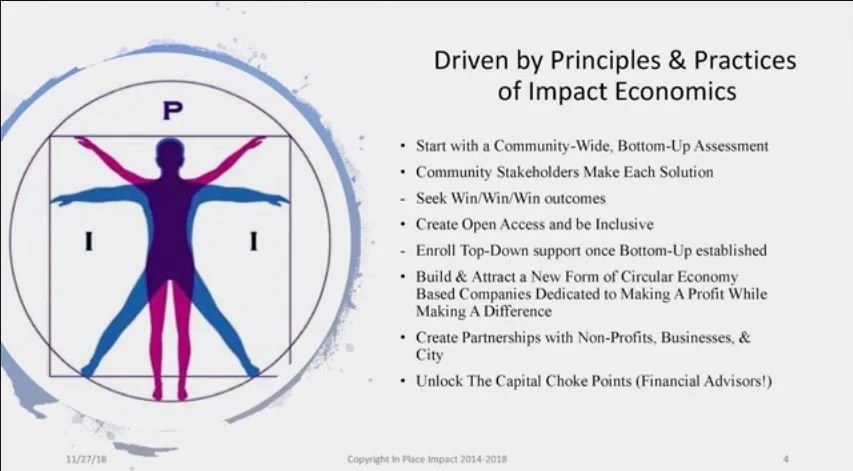

Read MoreEvery Individual and their respective community is facing the challenge of how to respond appropriately to the myriad challenges facing humanity in the 21st century. At the 2023 Earth Day celebrations held in Fairfield, Iowa, Stuart maps out an In Place Impact model to illustrate how far down the road Fairfield has come in building a broad-based "sustainability culture" and the Herculean work ahead! The In Place Impact model maps an accessible roadmap for each of us to consider for our own path towards hopeful engagement in service of the communities we call home.

Read MoreThis is the culmination of a near 50-year hero’s journey that has helped move the financial industry away from measuring success exclusively through the lens of financial profit (the reductionist single bottom line) to a more comprehensive triple bottom line metric driven by ESG data.

Read MoreMy take on the Silicon Valley Bank collapse is that on the one hand, I am grateful that we have a Federal Reserve Bank in the role of "lender of last resort," to step in when these breakdowns occur. On the other hand, it is precisely the source code of “money-as-debt” and the “debt-based growth model,” that the privately owned Federal Reserve system was designed for, that has created the conditions for this type of brittleness in our economy. It is a great model if your goal is to always maximize financial profits everywhere, but it falls short if the goal is to create long-term environmental health and social well-being.

Read MoreThe current war in Ukraine and mounting headwinds to the bull market in stocks of the last 12 years are giving us investors a first-hand reminder that investment losses are an integral component of achieving long term success. After all, the principle of “buy low, sell high” can only be activated if we can stay objective during the intense moments of fear and uncertainty and deploy the methodology of rebalancing though the bear market periods.

Read MoreI joined my first co-op when I was 15, while living on my own, going to school at the Children’s Theatre Company, and subsisting on bags full of tamari-roasted almonds and organic raisins. After surviving an aggressive form of cervical cancer at 19, I became macrobiotic, and Saint Paul’s original Mississippi Market became my new lifeline.

Read MoreDIVESTING is the act of selling investments, or banning new investments, in areas of ethical and/or financial concern. The modern divestment movement started in 1758, when the Quaker yearly meeting unanimously issued a proclamation forbidding its members from profiting from the slave trade. Drawing from that 200-year-old example, divestment was used as tool to fight apartheid in South Africa in the 1970s and ’80s.

Read MoreMany of us approach our personal finances with a sense of shame on the one hand or of “doing the right thing” on the other. Very rarely do we approach our own finances with a sense of kindness; kindness for ourselves, kindness for the people we provide for and kindness for the world at large. And yet, care is at the heart of most financial choices we make.

Read MoreACROSS THE SPECTRUM OF PEOPLE I ENCOUNTER, from quite wealthy to not at all wealthy and young to old, there is despair about the current role of money in the world. As one new client recently said to me, “I guess I believe that capitalism is irredeemably evil.” That isn’t an easy thing for a financial advisor to hear, but it is a real sentiment for many of us if we give our despair a voice.

Read MoreAs a conscientious investor, how do you know what to do when you get those shareholder letters in the mail asking you to send in a proxy vote? There are several shareholder advocacy organizations that compile impact data on companies and mutual funds so that...

Read MoreGender lens investing is among the latest trends in impact investing. This approach to investing advocates gender equality for cis and trans girls and women. Recently, a client asked about our approach here at Centered Wealth. Our initial conversation with clients...

Read MoreOur unique approach to Impact Investing https://centered-wealth.com/wp-content/uploads/ImpactU-interviews-Jina-Penn-Tracy-of-Centered-Wealth0D.mp3 For ImpactU Steve Distante interviewed me on my holistic approach to impact investing. Authenticity comes from intrinsic...

Read MoreSocially conscious and impact investors don’t behave like traditional investors. In my experience, they tend to hold steady during market fluctuations and stay invested over the long-term. They care as much about clean air and water as they do about how their investments are performing…

Read MoreIn this presentation, investment advisors Jina Penn-Tracy and Stuart Valentine, co-founders of Centered Wealth, presented the Centered Wealth Tree model, an integral approach to the financial planning & investment management process. The Centered Wealth model moves from the inner world of the individual into investment in the future we wish to manifest together.

Read MoreIn July I attended a two-day thought leadership summit, Philanthropy Transforming Finance: Building an Impact Economy. The summit was part of a larger initiative identifying the need for funders to work collaboratively to place longer-term, adaptive resources to fund...

Read MoreFrom a Centered Wealth client who became motivated to do more: I came into the financial planning field through an unconventional path— that is, not from the world of finance, but from my personal experience of moving money into socially-conscious investments. The...

Read More